Register Your Company:

You’ve got tons of options. Some are better than others. Some are dependent on how your company is structured and/or your mission. You can file as an LLC, an S-Corp, a nonprofit organization…the list goes on. You can consult a business attorney, LegalZoom, or your uncle Phil who sells one of a kind Hawaiian shirts at the local farmers market. Barn Door Hostel chose to file as a Limited Liability Company (LLC).

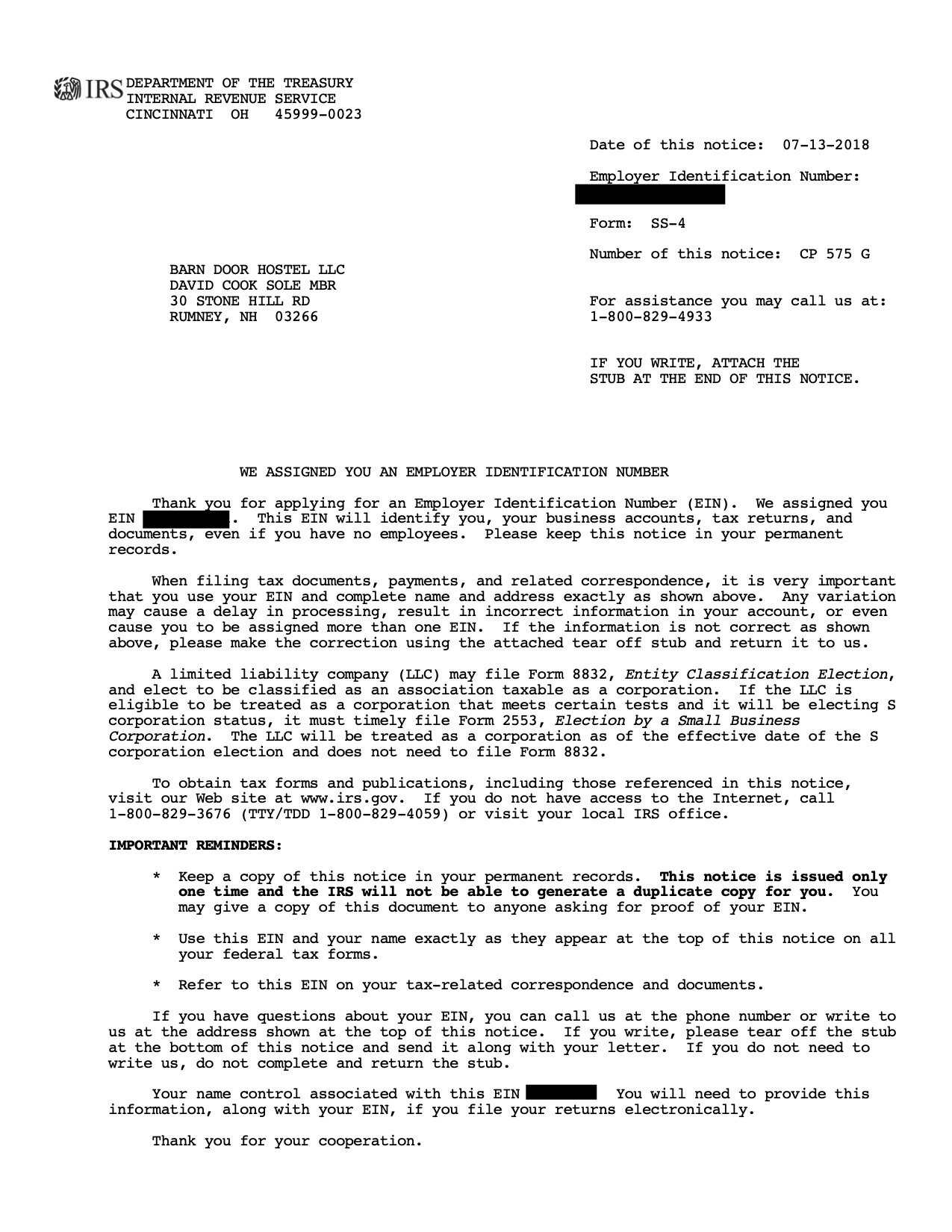

if you don’t want your type of company (eg LLC) at the end of your name on everything, file a Doing Business As (DBA*) for whatever you actually want your company to be called. example: Instead of “Barn Door Hostel LLC” written on everything, we’ve filed a DBA under “Barn Door Hostel” as well as “Barn Door Hostel & Campground”. *If you choose not to file a DBA (for an LLC at least), you are required by law to have LLC on basically everything. Signage, business cards, emails, websites, receipts, etc. It’s annoying and ugly for some, its totally fine for others. Ultimately its up to you as the business owner what you want to portray to your customers. Once you register, you will get something called an Employer Identification Number-or EIN (this is basically your businesses social security number). Depending on how you register, you may not get an EIN and in fact use your real personal SSN for the business. When you file, You’ll get a document from the IRS that looks similar to the one below:

File Your Taxes Monthly:

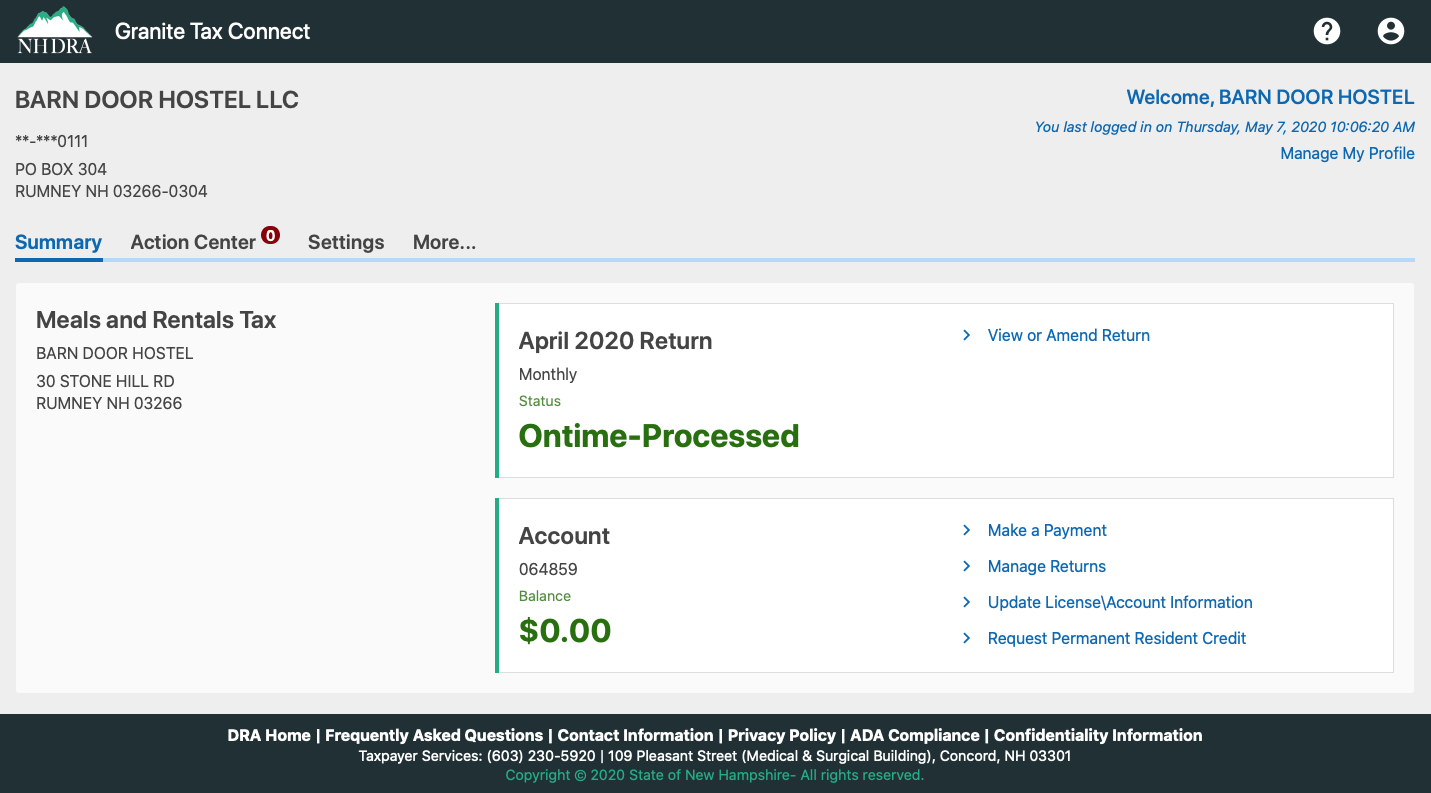

Once you register as a lodging establishment, you are required to collect a 9% Rooms (and Meals) tax per customer. This is per customer. Make sure you keep accurate records of these collected taxes as you will have to report them to the NH government once per month (usually due on the 15th of the month for the previous months activities) This is done on the Granite Tax Connect website. It will look something similar to the image below. You need to create an account with the website (using your EIN).

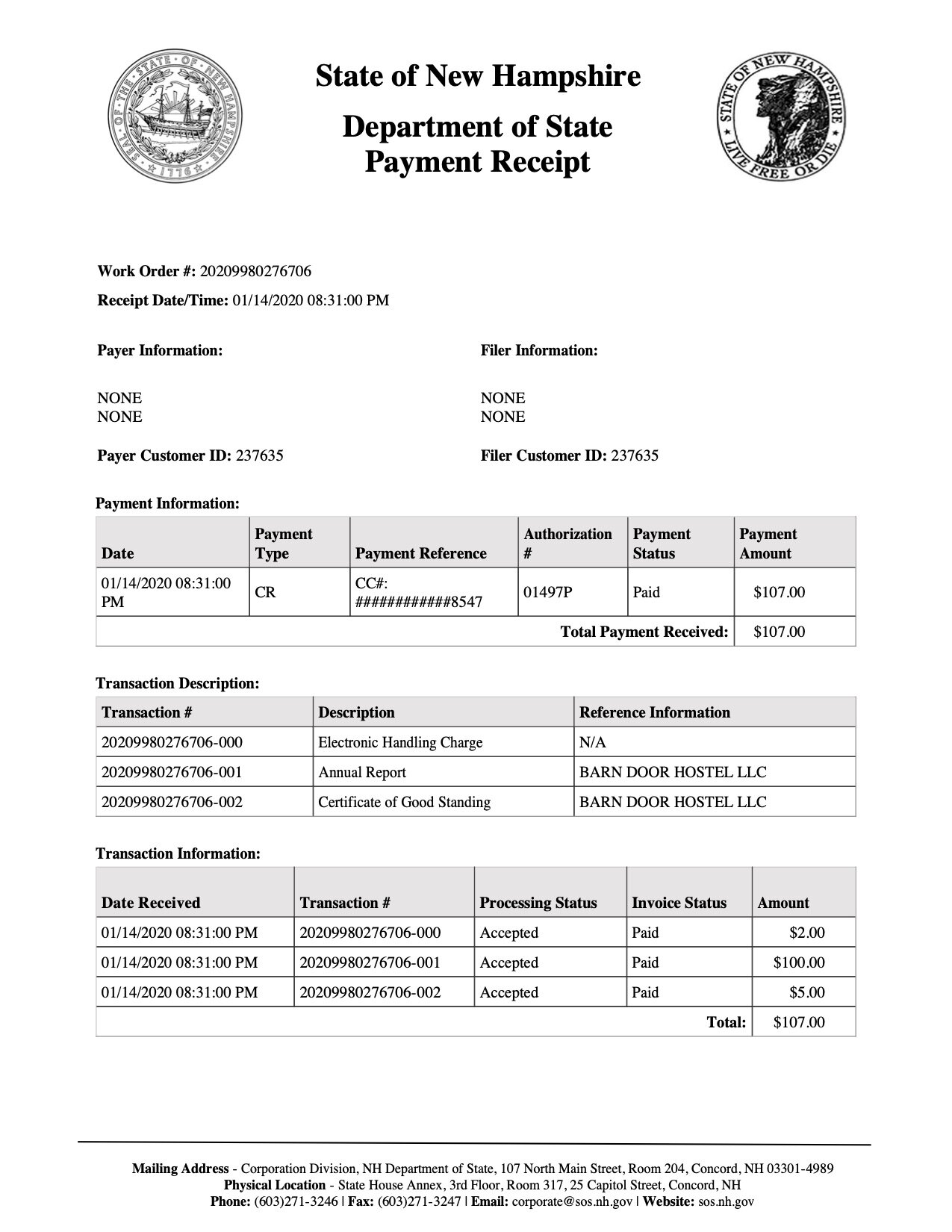

Make sure your business is in good standing (once a year)

Register your business with NH Quickstart (usually done when you form your business). You need your EIN, business name, your name and some other essentials. In order for the NH government to understand that you’re still a real functioning business who doesn’t owe anyone anything, you need to make sure your business is in good standing. This is done by logging in th NH Quickstart once per year (around the time you formed your company) and paying a fee. Here’s a receipt of Barn Door Hostel’s most recent “Good Standing” transaction

Business Insurance:

This one is tricky. Tons of insurance companies in the state, and the nation, don’t really want to be associated with hostels as they have bad reputations and/or are “new” or “unheard of”. One company that we work with (we have multiple insurances for multiple things [homeowners, property, campground, business]) is E + S Insurance Services. Our agent is Eleanor (the E in the name) and she is an absolute sweetheart of a woman who is very patient and understanding of small business needs. We tried other companies (that currently insure hostels in New Hampshire) and were told that none of these insurance companies are accepting any more hostels as clients. This may change in the future but for now, E + S is highly recommended.

Any other business formation information we forgot? Let us know in the comments